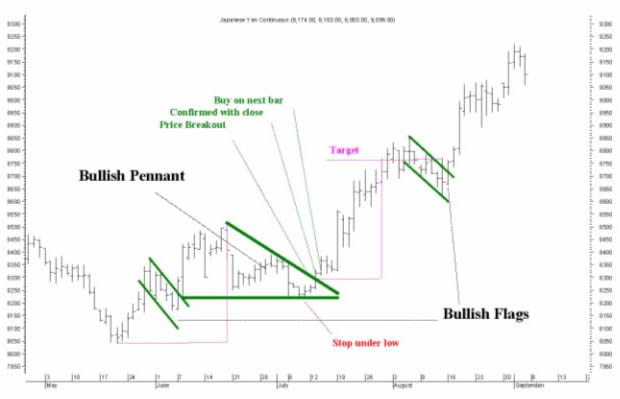

Pennants and Flags are short-term continuation patterns and are among the most reliable of all continuation patterns, they are formed when there is a sharp price movement followed by a consolidation phase (sideways action), thereafter the previous up or down trend is expected to resume.

Flags and Pennants are marked by two trend lines. At its top, there is a line of resistance where traders are willing to sell the currency pair.

At it's bottom, there is a line of support where traders are willing to buy the currency pair.

What do Flags and Pennants Formations look like?

What's the main difference between Flags and Pennants?

A Flag consists of 2 parallel trendlines (support and resistance) that slope against the previous trend. The Pennant consists of two converging trendlines that begins wide and converges and is a very short term Symmetrical Triangle.

How to trade these patterns?

Always trade Flag and Pennants in the direction of the previous (main)trend:

(1) If the previous trend was up, wait for a break out to the upside and go long when the currency pair rises above the upper resistance trendline.

Place your stop a few pips below the lower support trendline.

(2) If the previous trend was down, wait for a break out to the downside and go short when the currency pair falls below the lower support trendline.

Place your stop a few pips above the upper resistance trendline.

Chart examples

Bullish Pennant and Bullish Flags

|

|

There are so much ways to make money on the internet or you can say online. You can do article writing and can write the blogs as well.

ReplyDelete